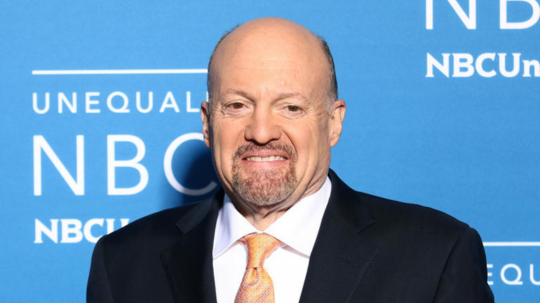

Jim Cramer is a widely recognized television personality renowned as the host of CNBC’s “Mad Money” and the creator behind the CNBC Investing Club. His financial guidance has resonated with countless Americans aspiring to build wealth through investment. He emphasizes the importance of frugality and prudent savings as prerequisites for successful investing.

Cramer, a former hedge fund manager, has an estimated net worth of approximately $150 million. His journey to wealth began at a remarkably young age, achieving millionaire status by the age of 28. However, his advice on achieving prosperity extends beyond the realm of investment. He stresses the significance of mindful spending and urges individuals to allocate their resources thoughtfully. Here, we delve into seven areas where he prioritizes economical spending, offering insights that warrant consideration.

Discretionary Expenses

Cramer advocates for cultivating frugality, particularly among the younger generation. He observes that Generation Z often allocates substantial sums toward non-essential items, subsequently lamenting their inability to invest. His recommendation involves channeling funds typically spent on post-work entertainment into investments, showcasing the potential of even small amounts to yield considerable returns over time.

Prioritizing Expenditures

For those uncertain about where to start, Cramer suggests aligning spending with personal priorities. If one can forgo certain leisure activities, those funds could be redirected into investments. Over time, these seemingly minor investments can accumulate, potentially resulting in substantial gains. Cramer’s commitment to frugality remains steadfast even in light of considerable wealth.

Prudent Lodging Choices

Known for his frugal inclinations, Jim Cramer doesn’t shy away from opting for modest lodging accommodations. He maintains that luxurious hotel rooms, if not extensively utilized, represent an unnecessary expense. He encourages travelers to define the focus of their trip and allocate resources accordingly. If a room will primarily serve as a place to rest, excessive spending on accommodations may be unwarranted.

Generic Products Over Brands

Cramer dismisses the notion of brand loyalty, a perspective he shared with CNBC’s Make It. He’s content shopping at retailers like Costco and favoring their Kirkland brand, as generic products often closely resemble their brand-name counterparts. The primary distinction lies in the price tag. As a result, he promotes opting for more budget-friendly store brands when quality remains consistent.

Prioritizing Investment Quality

A fundamental aspect of Cramer’s investment philosophy revolves around favoring quality companies. He encourages individuals not to shy away from investing more in top-tier stocks. Conversely, he advises against investing in lower-quality companies, which he believes could yield unfavorable outcomes. The potential benefits of high-quality stocks often outweigh the initial expense.

Ethical Investment Choices

While he previously endorsed investing in tobacco stocks, Cramer’s stance has since evolved. He cites the toll tobacco has taken on lives, including his late father-in-law’s, as a driving factor behind his changed perspective. Consequently, he encourages investors to align themselves with companies that uphold ethical values and offer quality products.

Thoughtful Dining Out Approach

Cramer’s reluctance to overspend on alcohol at restaurants stems from the substantial markup involved. A premium of 20% to 30% for drinks at dining establishments prompts him to opt for cost-effective alternatives, given the feasibility of recreating similar beverages at home. Notably, alongside his media presence, Cramer’s involvement in the restaurant industry underscores his practical experience.

Mindful Sports Ticket Choices

Cramer refrains from investing heavily in expensive sports tickets, with one notable exception—football. As a fervent Eagles fan, he occasionally indulges in luxury box seats for football games. His preference for savoring the game itself over extravagant seating epitomizes his pragmatic spending approach.

Simplified Financial Strategy

Emulating Jim Cramer’s financial approach doesn’t require complexity. Many of his recommendations revolve around prudent spending and allocating any available discretionary income toward investments. Even individuals who believe they lack surplus funds can identify small amounts to invest with discipline. Escaping the cycle of living paycheck to paycheck becomes feasible through wise choices and a willingness to make sacrifices.